We offer:

Housing

We build and operate safe, secure social and affordable housing for women and other eligible applicants.

Support programs

Our local support programs can help you stabilise your current situation, access and maintain housing, and make progress on your goals for your future. Find a program

Leadership pathways

Pathways to build your skills, knowledge and confidence, find opportunities to make a difference and connect with a like-minded community. Find pathways

Our impact

6,000+

people supported each year

130,000+

nights of safe, stable and affordable accommodation provided each year

64,000+

hours of support provided each year

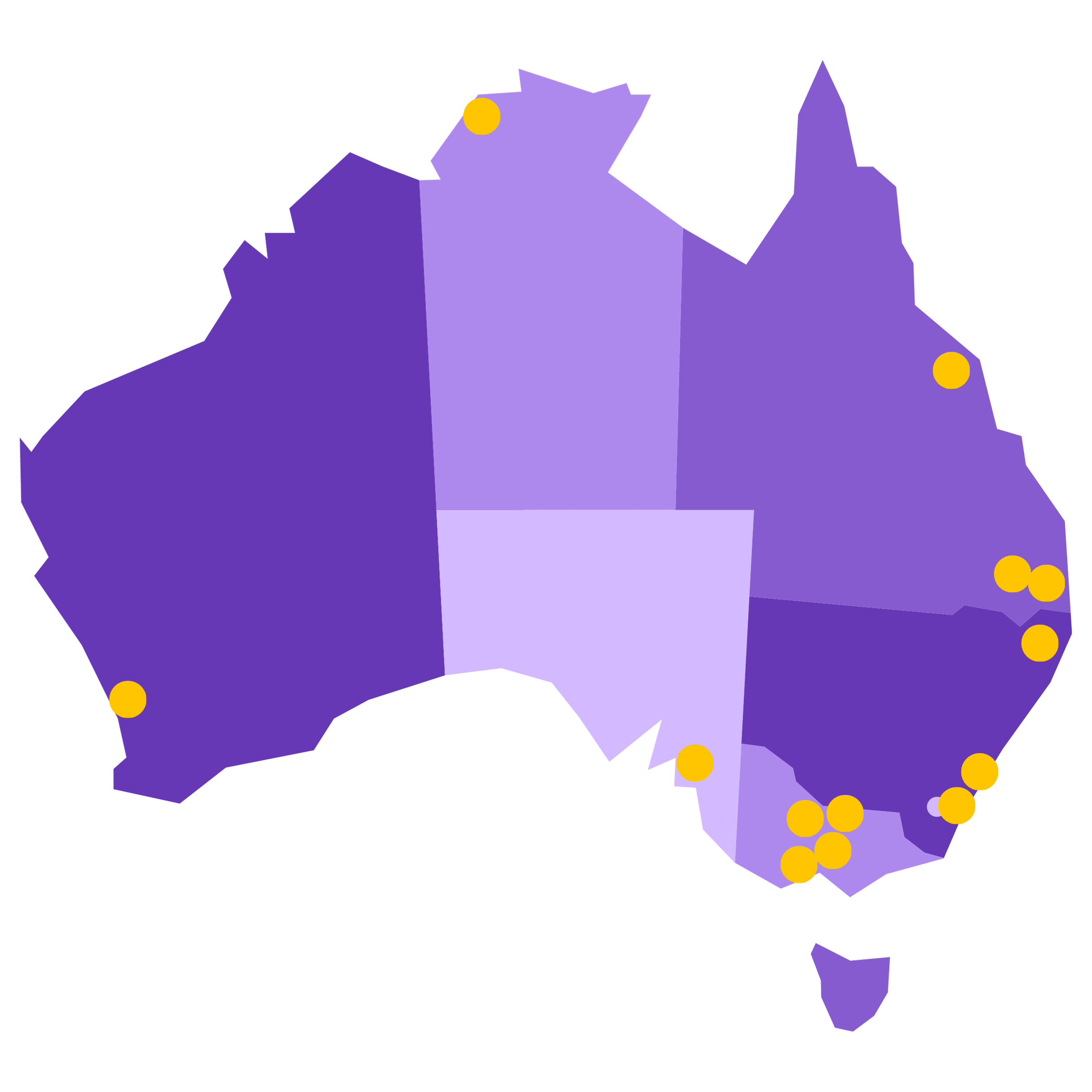

Where we are

We deliver housing, services and support programs in 17 communities.

Our advocacy and leadership pathways have a national footprint.

- Northern Territory: Darwin and Palmerston

- New South Wales: Bowral, Lismore, Sydney, Nowra, Wollongong

- Queensland: Toowoomba, Townsville

- South Australia: Adelaide

- Victoria: Ballarat, Bendigo, Geelong, Melbourne Mooroopna, Wodonga

- Western Australia: Perth

"It’s been quite a hard and long journey … we’ve couch surfed, shared bedrooms and at one stage we even slept in a tent. It took a lot of tears, but we got there – I cried when I got the call … it was a miracle."

YWCA tenant - QLD, Misty in response to her new home

News and media

All-woman crew building affordable housing for SA women impacted by violence

Belinda Goglia, YWCA Australia Senior Manager Property Development, said the affordable rental apartments for women-led families were on track for […]

YWCA Australia commends the National Strategy for Gender Equality but calls for action on housing

YWCA Australia commends the Albanese Government on the release of Working for Women: A Strategy for Gender Equality; an important […]

YWCA Australia welcomes new research on Gendered Housing Matters

YWCA Australia welcomes new research released today from the Australian Housing Urban Research Institute (AHURI) “Gendered Housing Matters” which reinforces […]